Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

There are many signs that US global dominance is coming to an end.

This trend is linked largely to the continued devaluation of the US Dollar and the weaponization of the US Dollar has accelerated what was already likely inevitable in my view.

This week, we’ll look at some signs of weakening US influence globally.

For starters, it was just reported that the United States is no longer the world’s largest exporter of corn. That title now belongs to the BRICS country, Brazil.

This (Source: https://www.zerohedge.com/geopolitical/multipolar-world-emerging) from “Zero Hedge”:

It appears that a new world order is emerging, with BRICS and the Shanghai Cooperation Organization offering trade alternatives to the hegemonic West. The latest example of a multi-polar world is the US being displaced by BRICS country Brazil as the world's top corn supplier.

The US held the crown for fifty years as the world's top corn exporter. A new Blomberg report, citing data from the US Department of Agriculture (USDA), shows the five-decade reign is over:

In the 2023 harvest year, the US will account for about 23% of global corn exports, well below Brazil's nearly 32%, US Department of Agriculture data show. Brazil is seen holding onto its lead in the 2024 planting year that begins Sept. 1, too. Only once in data going back to the Kennedy administration did America drop out of first place before: for a single year in 2013 following a devastating drought. The US corn-exporting industry has never before spent two back-to-back years in second place — until now.

It's not corn. Brazil has also displaced American farmers in both soybean and wheat exports. Bloomberg explained more:

Losing its lead in corn exports may feel familiar to American farmers, who in the last decade have also relinquished the top spot in both soybean and wheat exports. Soy was the first to go, with Brazil definitively taking the lead in 2013. The next year, the US lost its wheat dominance, too, with the European Union, then Russia, beginning to elbow out American farmers in the global market.

The export ag market share slide is troubling news for the domestic industry that exported $200 billion in farm products in 2022. Sliding dominance may suggest that farmer incomes may slide in the years ahead.

Stephen Nicholson, global grains and oilseeds sector strategist with Rabobank, an agricultural lender, told Reuters:

"When we look at US corn demand long term, we wonder where new demand is coming from.

"Brazil is likely taking a bigger share of the global market, ethanol has likely peaked and animal protein is likely not going to grow fast enough."

The reason for the shift is a rejiggering of China's ag trade away from the US to Brazil. China signed a deal with Brazil last year to increase gain purchases.

"Brazil has the ability to ramp that planting area up to meet Chinese demand in a way that the United States doesn't," said Matthew Roberts, senior grain analyst with consultancy Terrain.

Plus, the Chinese are steering clear of US trade because lawmakers on Capitol Hill have been in a frenzy to weaponize the dollar and trade against Beijing.

International trade is changing and changing quickly.

Due to the weaponization of the US Dollar, many countries around the world are aggressively looking to bypass the dollar in trade. This from MSN (Source: https://www.msn.com/en-us/money/markets/china-seizes-opportunity-amid-us-sanctions-to-challenge-dollar/ar-AA1fJOIW):

The US dollar, once the undisputed titan of international trade and finance, is witnessing a formidable challenger rise from the East. China, seeking to capitalize on the shifting dynamics of the global financial system, is leveraging every opportunity to whittle away at the dollar’s long-held supremacy.

Argentina’s recent decision to make a payment to the IMF in renminbi rather than dollars offers a glimpse into the changing undercurrents of global finance. It wasn’t an isolated incident either.

Bangladesh, previously reliant on the dollar, turned to the renminbi to finalize payments for a nuclear power plant with Russia when the weight of US sanctions made traditional routes untenable.

Such moves underline the growing exasperation of developing nations with the domineering presence of the US dollar. The rise of emerging powers like China, India, and Brazil has also spotlighted the absurdity of an international financial system heavily skewed towards the US dollar.

While the concept of “de-dollarization” was once dismissed as a far-off dream, today’s geopolitical landscape paints a different story.

The aggressive use of US economic sanctions and the proliferation of novel payment technologies have exposed vulnerabilities in the dollar’s position, and China stands ready, hungry to exploit these openings.

Beijing’s aspirations aren’t to dethrone the dollar overnight but to methodically erode its dominance. To comprehend the scale and depth of China’s ambition, one need not look further than its multifaceted approach to creating an alternative global payments system.

One of its prime targets has been Belgium’s Swift, the juggernaut behind approximately 90% of international monetary transfers. China’s response? A multi-pronged strategy yielding tangible outcomes.

On one front, Beijing endeavors to swell the pool of renminbi liquidity in offshore markets, enhancing its availability to traders and investors. Another bold move is the establishment of the Cross-Border Interbank Payment System (Cips), positioning it as a formidable competitor to Chips and Swift.

Its effectiveness is underscored by the fact that settlements on Cips surged by over a fifth to Rmb97tn in 2022. Moreover, the global debut of the digital renminbi is poised to revolutionize transactions, allowing them to bypass western financial mechanisms entirely.

The Chinese Cross-Border Interbank Payment System is gaining in popularity. This from “China Daily”. (Source: https://global.chinadaily.com.cn/a/202309/01/WS64f1b37da310d2dce4bb3762.html)

The Cross-border Interbank Payment System, or CIPS, processed 1.62 million transactions worth 29.49 trillion yuan ($4.06 trillion) in the second quarter of the year, up 60.4 percent and 29.04 percent year-on-year, respectively, the People's Bank of China said on Friday.

On average, CIPS, which specializes in renminbi cross-border payment clearing, processed 26,100 transactions worth 475.57 billion yuan on a daily basis in the second quarter, the PBOC said in a report on Friday.

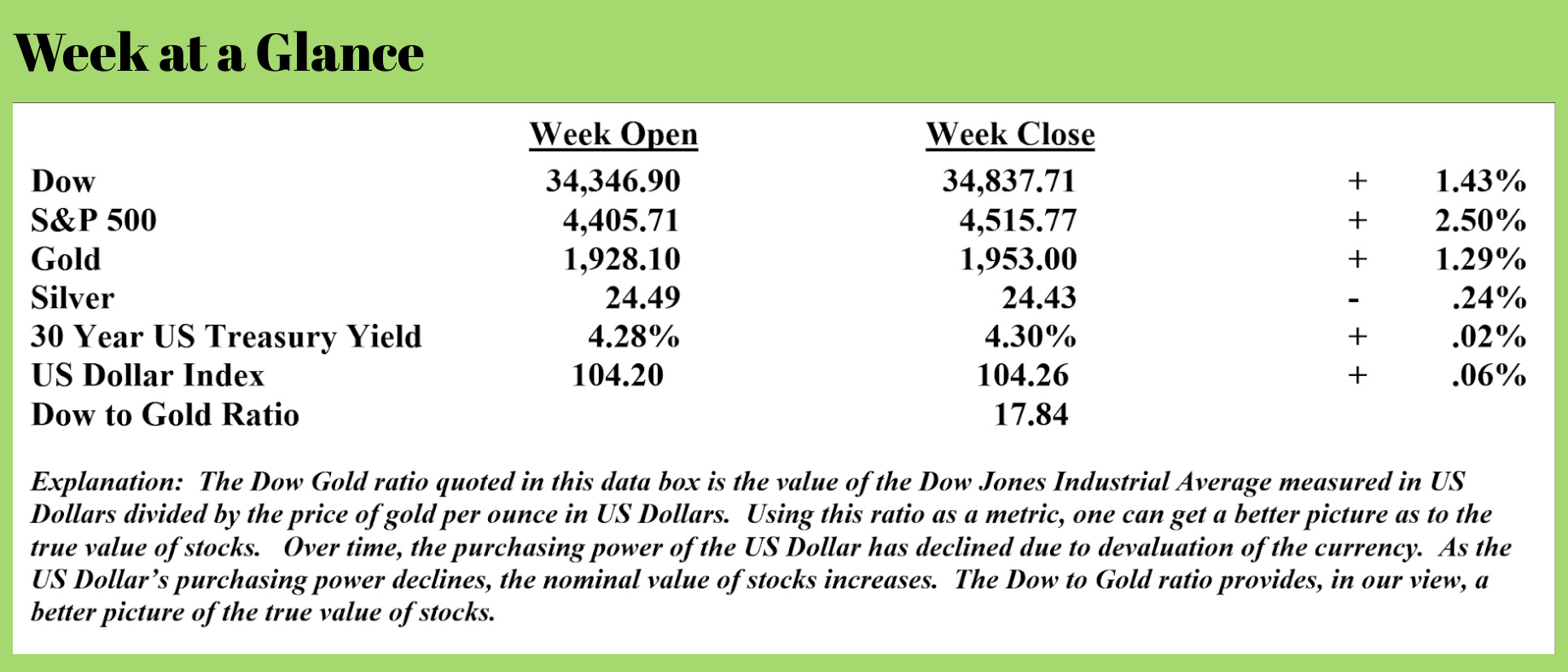

One needs only to look at a chart of US Government bonds to see this clearly.

The chart below is a weekly price chart of an exchange-traded fund that tracks the price of US Treasury bonds. Notice from the chart that from March 2020, US Treasury bonds have fallen in price by 47%!

Notice from the chart that from March 2020, US Treasury bonds have fallen in price by 47%!

US Government bonds have fallen in price by nearly half in just 3 ½ years!

While the recent BRICS summit did not end up with a new currency being announced, Saudi Arabia was welcomed as one of the new BRICS coalition countries.

Earlier this year, Saudi Arabia began to sell oil in currencies other than the US Dollar, dealing a significant blow to the Petro-Dollar.

These trends are likely to continue and intensify as time passes.

I’m reminded of the Hemmingway quote about bankruptcy. He said (I’m paraphrasing), “You go bankrupt slowly at first, then all at once.”

The radio program this week features an interview with me by Jeremy Bolker.

We discuss my economic forecast in great detail for the entire program. You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.”

-Ernest Hemmingway

Comments