Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

There are signs that the economy is beginning to slouch toward recession.

This week, we’ll look at a few of those signs and some events that will have at least some effect on the US economy.

Let’s begin with the fact that inflation got hot again in August. I have been repeatedly making the point that inflation cannot be controlled until the US government operates with a balanced budget. The most recent inflation numbers seem to validate that. This from “Zero Hedge” (Source: https://www.zerohedge.com/personal-finance/producer-prices-soar-august-goods-inflation-reignites):

After yesterday's hotter than expected rebound in CPI, all eyes are on PPI for signs that the pipeline for inflation may be more dove-friendly.

It wasn't!

Producer Prices rose 0.7% MoM in August (up from +0.3% in July and hotter than the +0.4% exp). That is the hottest PPI since June 2022, and pushed YoY prices up 1.6%...

Wolf Richter pointed out that inflation is hotter despite some distortions in the weightings relating to healthcare. This from Mr. Richter (Source: https://wolfstreet.com/2023/09/13/the-acceleration-of-inflation-in-the-second-half-has-begun-disinflation-honeymoon-terminated/)

The Consumer Price Index (CPI) jumped by 0.63% in August from July, the biggest month-to-month increase since June 2022. Annualized, this amounts to a red-hot 7.8%.

This jump comes despite the still ongoing ridiculous monthly adjustment to the health insurance CPI that caused it to collapse by 33.6% year-over-year. The September CPI, to be released in October, will be the last month with that adjustment; with the October CPI, to be released in November, it will flip, which will add upward momentum to the CPI readings. CPI, core CPI, and core services CPI have been understated significantly since October last year, when the monthly health insurance adjustment started, one of the biggest data distortions coming out of the pandemic (more in a moment).

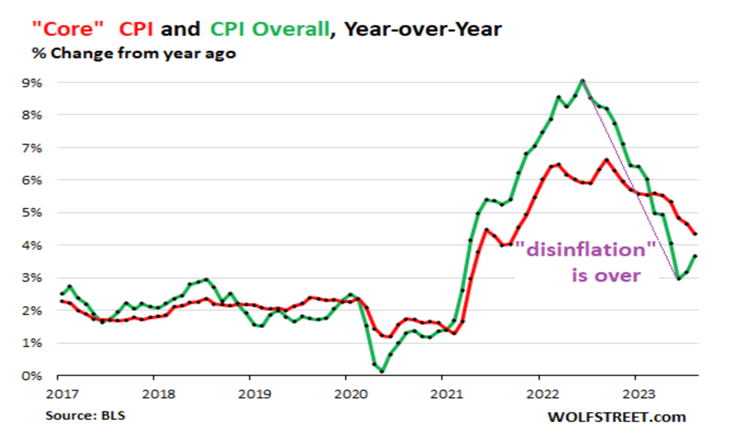

With this month-to-month spike, the year-over-year CPI rate accelerated to 3.7%, the second year-over-year acceleration since June 2022, according to the Bureau of Labor Statistics today (green in the chart below). July had already marked the end of the period of “disinflation” when the year-over-year inflation rate accelerated for the first time since June 2022.

The “Core” CPI, which attempts to track underlying inflation by excluding the volatile food and energy products, rose by a still hot 4.3% in August, compared to a year ago (red in the chart).

Given the narrower focus of core CPI, and the therefore proportionally bigger weight of health insurance in it, core CPI was even more distorted than overall CPI by the 33.6% collapse of the health insurance CPI.

I expect accelerating inflation moving ahead, making it tougher for even more Americans to meet their day-to-day living expenses. As noted previously, this is extremely bad news for a US economy dependent largely on consumer spending for its health.

Speaking of day-to-day living expenses, gas prices are once again rising. This from “Just the News” (Source: https://justthenews.com/politics-policy/energy/oil-prices-increase-90-barrel-gas-prices-expected-rise):

Gasoline prices are now at least $4 a gallon in a dozen states amid rising global oil prices.

Oil prices on Thursday were for the first time in 10 months over $90 a barrel, which could further increase gas prices.

The cost of gas typically declines following the summer holiday travel season because demand declines, but the cost this week is just pennies away from their highest level of the year, according to CNN.

According to AAA, the national average for regular gasoline is now $3.86 a gallon –16 cents higher than the same day last year. Plus, a dozen US states are already averaging $4 a gallon or higher for regular gasoline, including.

Colorado, North Dakota and California are among the states in which the average gas price is over $4 a gallon.

Rising energy prices reduce discretionary income and act as a drag on consumer purchases.

Home purchases are also feeling the effects of this economic slowdown catalyzed by Federal Reserve interest rate increases. This from “Redfin” (Source: https://investors.redfin.com/news-events/press-releases/detail/976/redfin-reports-home-purchases-fell-through-at-the-highest)

Residential real estate deals are falling through at the highest rate in almost a year as high mortgage rates give homebuyers sticker shock, according to a new report from Redfin (redfin.com), the technology-powered real estate brokerage.

Nationwide, nearly 60,000 home-purchase agreements were canceled in August, equal to 15.7% of homes that went under contract that month. That’s up from 14.3% a year earlier and marks the highest percentage since October 2022, when mortgage rates surpassed 7% for the first time in two decades.

Gasoline prices up, housing costs up, inflation hotter; all bad news for the American consumer.

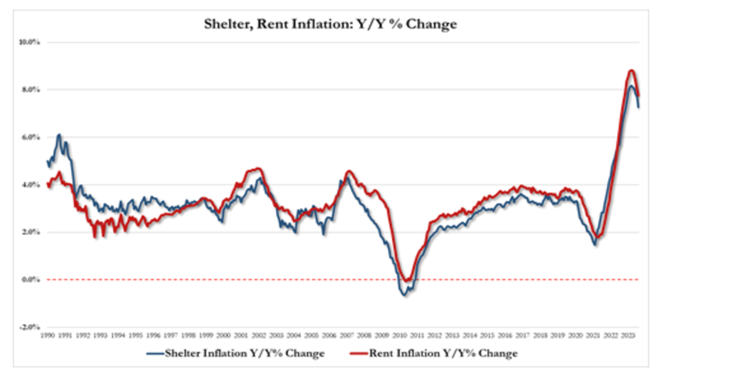

Seems that this is all adding up for the US economy. Manhattan rents, often considered to be a leading indicator for rent and shelter costs have suddenly begun to decline. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/manhattan-rental-market-peaks-affordability-wanes):

Demand for apartments across Manhattan slowed in August, a month typically marked by a surge ahead of the back-to-school season. This indicates that record-high rents have likely pushed potential renters to the sidelines. More broadly, this supports the latest inflation trends that show easing shelter costs.

Last month, the median rent in Manhattan was signed around $4,400, or unchanged from the record set in July, according to Bloomberg, citing new data from Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. The plateau in rent prices indicates consumers are balking at prices that have jumped 7.3% from a year ago and 35% from August 2021.

According to Jonathan Miller, president of Miller Samuel, August is usually one of the hottest months of the year as renters flock to the borough before the fall semester. However, last month, activity was underwhelming and slower than in May and June. He said new leases plunged 14% from a year ago to 5,025.

"We're still at or very near all-time highs, but we're continuing to see new leasing activity fall, and that's an indicator that the market is topping out," Miller said.

If Miller is correct, then the topping of rent prices in Manhattan would line up with broader shelter trends that have also eased.

Seems the consumer is collectively at his or her limit.

That likely means the economy is, too.

This week's radio program features an interview with the founder of Lear Capital, Kevin Demerit, and me. Kevin offers his take on the inflation discussion and also offers his views on what to do with at least some of your portfolio moving ahead.

Jeremy Bolker returns to the program this week as well and interviews me about my forecast for stocks, bonds, and gold moving forward.

You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“Excellence in anything increases your potential in everything.”

-Joe Rogan

Comments