Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

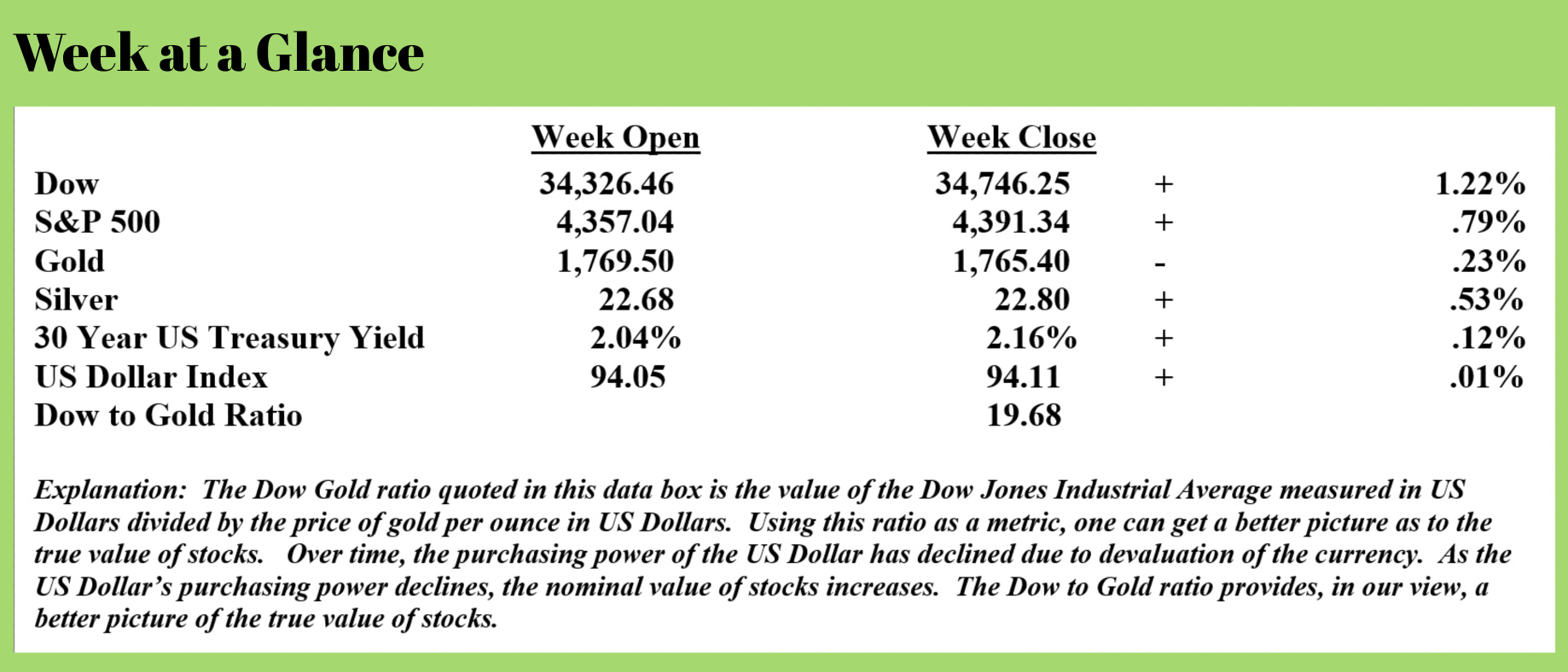

Stocks rallied last week although, as I noted last week, technically speaking, stocks look weak.

Last week, we noted that 4 stock market sectors were lagging. That was a significant development since all sectors that comprise the Standard and Poor’s 500 were positive going into October; that changed. It’s also relevant to note that historically speaking, many stock corrections have occurred or intensified in October.

It may pay to be cautious moving ahead.

There is often an event, sometimes referred to as a black swan event, that is the catalyst for a market correction to begin. As an example, in 2007, it was the failure of Lehman.

When one takes in everything happening around the globe politically, financially, and economically at the present time, there is no shortage of possibilities for a black swan event to serve as a catalyst to pop this bubble.

A couple of weeks ago, I wrote about Evergrande, the mammoth Chinese real estate investment company that was poised to default on its debt obligations. I suggested that Evergrande could be the calendar year 2021 version of Lehman. That could still be the case since the Evergrande story is far from over.

This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/catastrophic-property-sales-mean-chinas-worst-case-scenario-now-play) which suggests the worst-case scenario for Evergrande may now be a likely outcome:

No matter how the Evergrande drama plays out - whether it culminates with an uncontrolled, chaotic default and/or distressed asset sale liquidation, a controlled restructuring where bondholders get some compensation, or with Beijing blinking and bailing out the core pillar of China's housing market - remember that Evergrande is just a symptom of the trends that have whipsawed China's property market in the past year, which has seen significant contraction as a result of Beijing policies seeking to tighten financial conditions as part of Xi's new "common prosperity" drive which among other things, seeks to make housing much more affordable to everyone, not just the richest.

As such, any contagion from the ongoing turmoil sweeping China's heavily indebted property sector will impact not the banks, which are all state-owned entities and whose exposure to insolvent developers can easily be patched up by the state, but the property sector itself, which as Goldman recently calculated is worth $62 trillion making it the world's largest asset class, contributes a mind-boggling 29% of Chinese GDP (compared to 6.2% in the US) and represents 62% of household wealth.

It's also why we said that for Beijing the focus is not so much about Evegrande, but about preserving confidence in the property sector.

But first, a quick update on Evergrande, which - to nobody's surprise - we learned today is expected to default on its offshore bond payment obligations imminently according to investment bank Moelis, which is advising a group of the cash-strapped developer’s bondholders. Evergrande, which is facing one of the country’s largest defaults as it wrestles with more than $300 billion of debt, has already missed coupon payments on dollar bonds twice last month.

The missed payments, worth a combined $131 million, have left global investors wondering if they will have to swallow large losses when 30-day grace periods end for coupons that were due on Sept. 23 and Sept. 29. A separate group of creditors to Jumbo Fortune Enterprises who are advised by White & Case, are also waiting for a $260 million bond principal repayment after a bond guaranteed by Evergrande matured last Friday, and unlike the offshore bonds, does not have a 30 day grace period (although five business days 'would be allowed' if the failure to pay were due to administrative or technical error).

The Jumbo Fortune payment is being closely watched because of the risks of cross-default for the real estate giant’s other dollar bonds; it would also be the firm’s first major miss on maturing notes instead of just coupon payments since regulators urged the developer to avoid a near-term default. And with the five business days up as of today, and with a payment yet to be made, it appears that this weekend we will get news of a declaration of involuntary default from the creditor group which will set in motion the Evegrande default dominoes.

Without the “default dominoes” described in the article falling, China is already experiencing a real estate crisis. The same “Zero Hedge” article reports that 90% of China’s top 100 property developers saw year-over-year sales decline by 36% in September. Seems that the real estate collapse may have already begun in China and the Evergrande defaults will simply accelerate the decline.

Meanwhile, the headlines regarding the US economy are far from positive suggesting that the combination of economic weakness and overvalued stocks may be especially susceptible to a 2021 Lehman moment.

The September jobs report was extremely weak; this from “MSN” (Source: https://www.msn.com/en-us/money/markets/deporre-september-jobs-report-was-messy/ar-AAPjg9u)

"September jobs numbers came in lower than expected at 194,000, but it was a messy report with some big revisions to prior months and a sharp drop in the 'household' unemployment rate to 4.8%," Deporre wrote on Real Money. "The market has had a minor reaction to the news, but interest rates continue to rise, so there are still concerns about inflation despite the weak employment news."

And this from Reuters on the topic (Source: https://www.msn.com/en-ca/money/topstories/four-stand-out-points-in-the-september-us-jobs-report/ar-AAPhYHd):

For a second straight month, U.S. job growth proved to be bitterly disappointing in September, coming in more than 300,000 jobs short of what many economists had penciled in. That's after August's report initially came in almost half a million jobs below economists' consensus estimate.

A weak jobs report is combined with an economy that is contracting on a real basis. Many of you who are long-time readers are familiar with the work of John Williams of ShadowStats.com. Mr. Williams reports economic data using the methods that were used prior to those methods being manipulated to make the reported numbers look more favorable.

The chart on this page (www.ShadowStats.com) illustrating the official GDP annual growth and Mr. Williams’ estimate of the actual growth rate shows that in real terms, the US economy is still contracting while the officially reported GDP growth rate barely reaches 1%.

That at least partially explains the jobs report.

Couple a contracting economy with increasing inflation and you have a recipe for a Lehman moment.

Mr. Williams also calculates the inflation rate using the methodology that was used prior to 1980. Using that method to calculate the inflation rate, as you can see from the chart, the real inflation rate is about 13%, a lot higher than the officially reported Consumer Price Index of a little more than 5%.

For lower and middle-class consumers in a contracting economy, rising prices are exceptionally difficult.

Crude oil prices just topped $80 per barrel for the first time since 2014 (Source: https://www.cnbc.com/2021/10/08/us-crude-oil-price-tops-80-a-barrel-the-highest-since-2014.html?__source=sharebar|facebook&par=sharebar&fbclid=IwAR1lVdAgHf36bf7D3FWmj9ZppE40M5JV3GZ10k8E1qFATl4DzQsI-kUe6JQ) and food prices are up more than 30% in one year.

While it's possible the Lehman moment could be delayed, I believe it is inevitable.

This week’s radio program is an interview with commentator, author, and radio host Mr. Peter Schiff. I get Peter’s take on crypto-currencies and central bank issued digital currencies. It’s a lively interview, loaded with information that you won’t want to miss. Click on the "Podcast" tab at the top of this page to listen now!

“Fathers are men who give daughters away to other men who aren’t nearly good enough……. so they can have grandchildren who are smarter than anybody’s.”

-Paul Harvey