Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

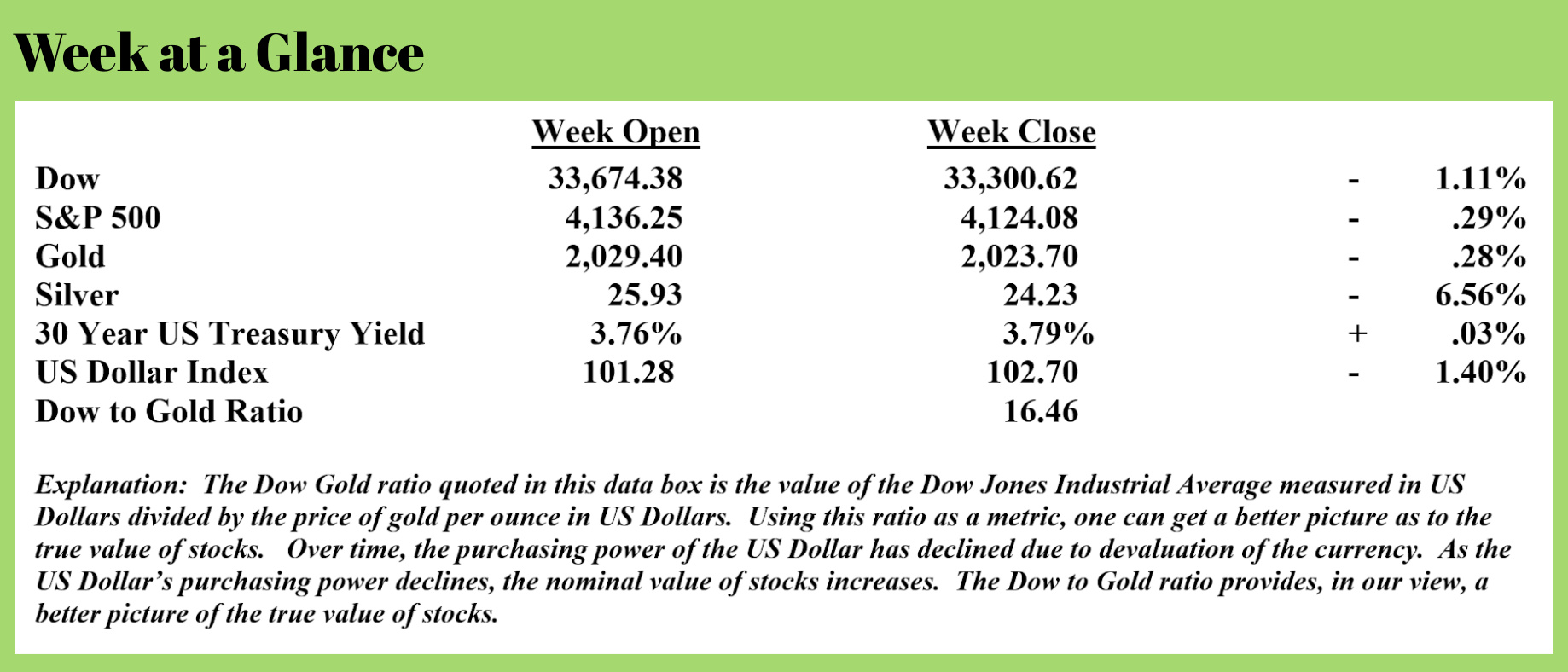

The Fed, the central bank of the United States, after increasing interest rates by .25% after its last meeting, issued a statement that was a bit different than other recent statements after the Fed decided to increase interest rates.

Here is a comment by Fed Chair Jerome Powell pointing out the differences between the Fed’s latest statement and prior statements:

“That’s a meaningful change, that we’re no longer saying that we ‘anticipate’” additional increases.”

So, does this signal the Fed is finished with increasing interest rates? Perhaps.

And does this mean the Fed is about to reverse the pattern of rate increases even though inflation is not contained?

I wouldn’t be surprised. If you’ve been a long-term reader of “Portfolio Watch,” you know that when the Fed embarked on this path of increasing interest rates, I suggested that it would be short-lived.

Seems that, based on Mr. Powell’s last statement, that may now be the case. We’ll have to wait to see for sure.

David Stockman, former budget director, wrote an interesting piece that offered a terrific perspective and great insight as to the bind the Fed now finds itself in. Here is an excerpt from the piece (Source: https://internationalman.com/articles/david-stockman-on-the-federal-reserves-great-pause-and-what-happens-next/)

In any event, the evident problem is that the Fed has backed itself into one hellacious corner. They are so addicted to interest rate pegging and manipulation that they cannot even see the absurdity of what they are actually doing.

To wit, since the turn of the century, they have so thoroughly flooded the financial system with excess liquidity and cheap credit that they can no longer even peg their traditional instrument—the Fed funds rate.

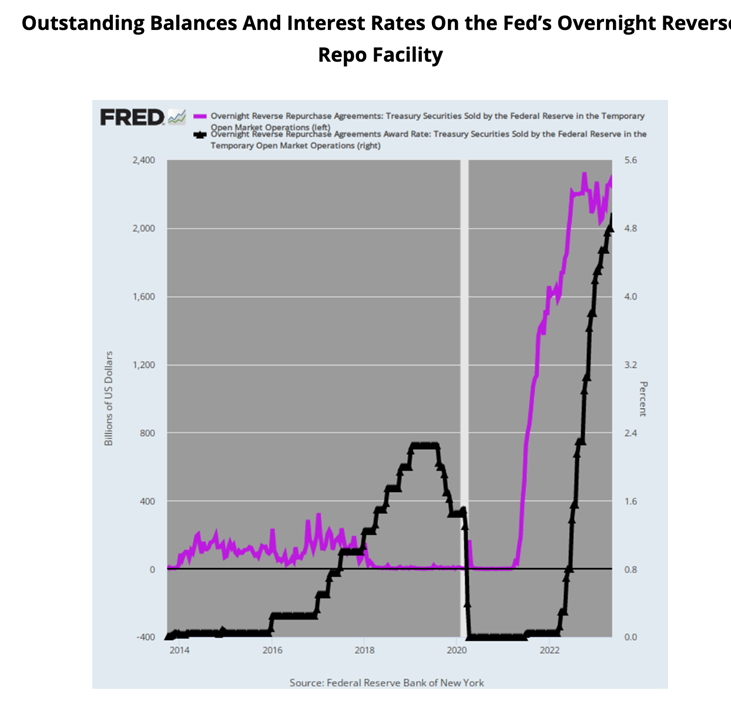

That’s why they have set up what is called the O/N RRP facility in the trade. It stands for overnight reverse repo facility, and when you strip away all the Fed-speak, it amounts to a giant borrowing window operated by the FOMC’s technicians at Liberty Street.

Presently, day in and day out, they are “borrowing” $2.3 trillion for the account of a central bank that can print money at will; and, in fact, has expanded its balance sheet from $500 billion to a recent peak of $9 trillion during the last two decades.

Nevertheless, as recently as March 2021, these overnight borrowings at the Fed’s O/N RRP facility totaled only $1 billion (purple line). So there has been a 2,200X expansion of the facility during the last 24 months.

Say what?!

It’s actually very simple. The Fed needed to pretend that it was raising interest rates in a financial system flooded with rate-depressing excess liquidity. So it used the O/N RRP to set a floor under money market rates by sopping up massive amounts of excess liquidity and then systematically raised the rate it pays overnight lenders from 5 basis points as recently as March 2022 to 480 basis points at present.

So where does all the money come from that was definitely uninterested in lending to the Fed at 5 basis points but more than eager at a rate 96 times higher?

Why, it’s the money market funds, which are now laughing all the way to the bank, so to speak. And to continue with that metaphor, in fact, where does all the surging inflows to the money market funds come from?

Why, the regulated commercial banking system, and most especially the regional banks!

In a word, the Fed is so tangled up in the underwear of its own monetary mechanics that it is actually causing the regional banking system collapse, which, in turn, may soon become the excuse to stop rate normalization and initiate the same rate-cutting disaster all over again.

So, yes, now is no time to stop. What is really needed is an end to Keynesian central banking and the abolition of monetary central planning.

Notice from the chart republished from Mr. Stockman’s article that the Overnight Reverse Repo Facility is presently ‘loaning’ more than $2 trillion.

Notice from the chart republished from Mr. Stockman’s article that the Overnight Reverse Repo Facility is presently ‘loaning’ more than $2 trillion.

The Federal Reserve's policies of cheap and easy credit over the last 20 years have pumped up nearly all asset prices to unsustainable levels.

Now, as interest rates are rising, bank deposits with little or no yield are moving from banks to other, more attractive vehicles with a higher yield. Stockman comments in his article (emphasis added):

To be sure, there is no mystery as to why these thundering bank runs are now underway. The Fed caused these banks to be flooded with absurdly cheap deposits, which, in turn, were pumped into higher-yielding long-term debt securities (blue area), commercial real estate (red area), and business loans (black area).

The problem, of course, is that the cheap deposits are now fleeing with alacrity, while small bank loans and securities books are increasingly underwater. Sharply rising interest rates and an economy visibly sliding into recession will do that!

Stated differently, these deposits never had a chance of being permanent at 25 basis points or less. Likewise, there was nothing sound about asset books which grew by 10% per annum between 2014 and the present in the three above-mentioned categories.

After all, during the same eight-year period, nominal GDP grew by only 3.2% per annum. Needless to say, true underlying demand for money at honest market rates did not grow at anything close to 3X GDP, meaning that these loans were not underwritten based on anything that even remotely resembled normal interest rates and a sustainable main street economy.

Now, it seems the Fed may be pausing interest rate increases. The question is, can they prevent a severe recession?

I’m very doubtful.

Are you ready?

The radio program this week is a ‘best of’ show that features an interview with Mr. Michael Pento, the host of the popular podcast, “Midweek Reality Check”.

I get Michael’s take on where the current banking troubles end up, as well as his forecast for inflation. We also chat about the coming storm in commercial real estate and the contracting M2 money supply.

If you haven't yet had a chance to listen to the show, click on the "Podcast" tab at the top of this page to listen now!

“A positive mental attitude may not solve all your problems, but it will annoy enough people to make it worth the effort.”

-Herm Albright

Comments