Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Ever since the updated “New Retirement Rules” book was published in 2016, I have been warning that debt excesses would lead to a severe deflationary environment.

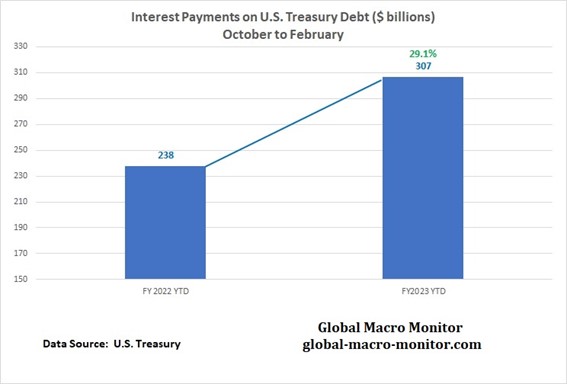

While such an economic climate has not yet fully emerged, there are signs that we are entering such a period. Stocks have fallen 20% from their peak, real estate markets are running out of steam, and the Federal Reserve is raising interest rates to attempt to tame inflation. Ironically, Federal Reserve easy money policies have led to the inflation we have been experiencing, and now the Fed is attempting to solve a problem that it had a big role in creating.

Meanwhile, as Americans are trying to deal with the inflationary environment, credit card debt has been rising – now topping $1 trillion for the first time in history. This1 from “ABC News”:

U.S. consumers’ total credit card debt exceeded $1 trillion for the first time, according to a new study by the personal finance website WalletHub.

Consumers took on an additional $92.2 billion in debt last year, the highest single-year amount since 2007. The average U.S. household owes $8,600 on credit cards, WalletHub found.

The accumulation of debt reflected Americans' confidence in the economy, according to Jill Gonzalez, a senior analyst at WalletHub.

“We haven’t seen anything like this,” she told ABC News. “Consumer confidence is at its highest point. Since the recession, people have been saving up for houses, cars ... new furniture and appliances, which often get charged on credit cards.”

I find it interesting that Ms. Gonzalez interprets such high credit card debt as somehow being good for the economy.

In my view, Ms. Gonzales’ rationale for such a conclusion is completely non-sensical. If consumers have indeed been “saving up” for major purchases like cars, furniture, and appliances, it seems that credit card debt would not be higher, instead it would be lower.

If I were saving up for a major purchase and elected to put the purchase on a credit card, I would be paying off the credit card balance on the due date to avoid interest charges.

This is NOT what is happening.

Instead consumers are carrying balances on their credit cards.

And, a quick review of the retail sales numbers confirms that this record high level of credit card debt is not due to retail purchases. This2 from “Market Watch”:

The numbers: Sales at retailers fell 0.4% in February and declined for the third time in four months, pointing to a slowdown in consumer spending as higher interest rates take a bite out of the U.S. economic growth.

Retail sales are a big part of consumer spending and offer clues about the strength of the economy. Sales had been forecast to fall 0.4%, based on a Wall Street Journal poll of economists.

Setting aside car dealers and gas stations, U.S. retail sales were still fairly tepid. Receipts fell at department stores, home centers and outlets that sell home furnishings, clothing and sporting goods.

Seems that these numbers invalidate the opinion of Ms. Gonzales.

It seems more likely that the reason credit card balances topped $1 trillion is that consumers are feeling the pinch of inflation and dealing with it by taking on debt.

Of course, this will only exacerbate the debt problem and make the eventual deflationary environment worse.

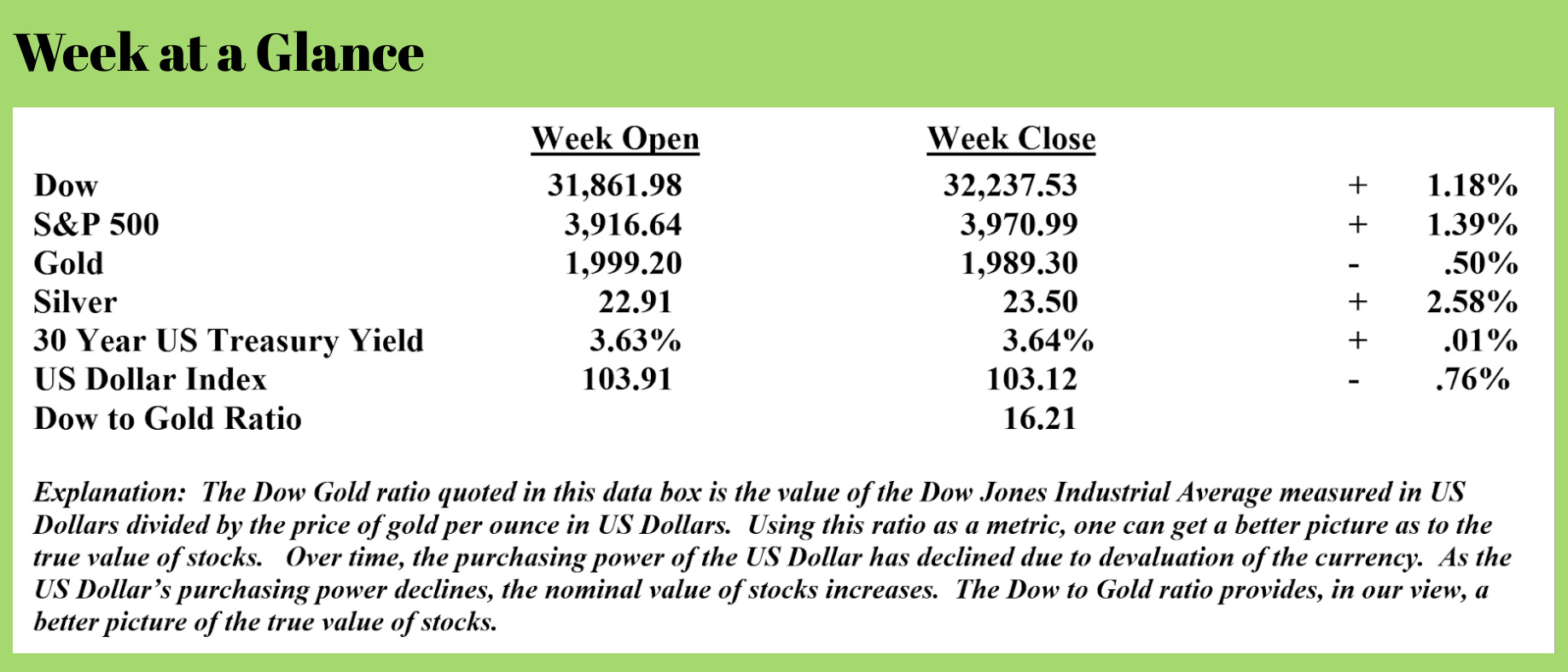

Another headwind for the economy and the government is the ever-increasing cost of servicing the US Government’s debt.

This4 from “Global Macro Monitor”:

Interest payments on the national debt during the current fiscal year (October to February) are up 29 percent y/y, one of the fastest-growing expenditure components of the Federal budget (see table).

Interest payments on the national debt during the current fiscal year (October to February) are up 29 percent y/y, one of the fastest-growing expenditure components of the Federal budget (see table).

Revenues are down, especially individual income taxes, which may reflect the slowing economy. Theory dictates (ceteris paribus) that government tax revenues should be rising with inflation, however. Hmmm.

The fact income tax receipts are lower, but self-employment tax revenues (1099 employees) are higher, coupled with what is happening with the employment data, can we hypothesize that high income earners are leaving the workforce (or getting fired) and starting their own businesses, such as consultants, for example? Or could it be just a timing issue?

The overall deficit is exploding, btw, up 50 percent.

If the current situation normalizes and Treasury securities lose their flight-to-quality bid, interest rates are going to spike faster than one of Elon’s rockets.

Interest costs to service the debt are higher, and tax revenues are lower (can you say recession?).

Worse yet, can you say financial crisis ahead? Whether it is around the corner or a few years off, the current spending trajectory is not sustainable.

As the economy slows, expect tax revenues to decline and deficits to widen even further.

The overriding theme of the current world economy is excessive debt. Debt excesses exist in the private sector and on the balance sheet of nearly every world government.

Applying a little common sense (which has almost gone the way of the dinosaur) to the current worldwide debt situation has one concluding that there is no way for the debt to be paid.

The only question is how long it will be before the full reset arrives.

In the April “You May Not Know Report,” we do an analysis on the insurance fund that insures bank accounts.

If you are a client of our company, you will automatically receive the report.

Please read it; it contains information that may be critically important in the current economy and in the present banking environment.

The radio program this week features an interview with returning guest Dr. A. Gary Shilling.

I talk with Dr. Shilling about what lies ahead for the US economy, as well as the stock, bond, and real estate markets. You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“By a continuing process of inflation, government can confiscate secretly and unobserved, an important part of the wealth of their citizens.”

-John Meynard Keynes

Comments