Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

Dow to Gold Ratio Falls

For more than ten years, since the publication of my “New Retirement Rules” book, I have suggested that we would reach a point where the Dow to Gold ratio would reach one. You can visit www.RetirementLifestyleAdvocates.com and create a free login to access all of the archived resources stored there to verify this forecast.

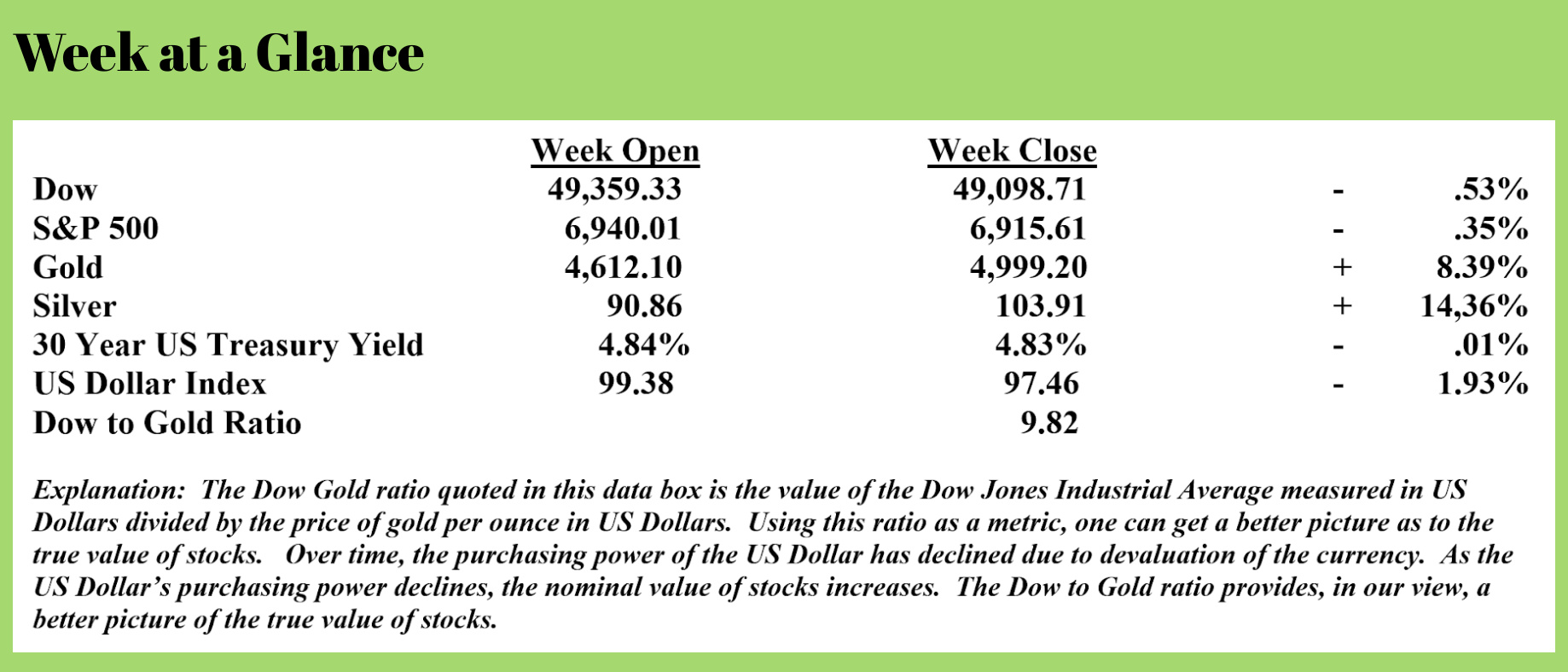

Last week, for the first time in a VERY long time, the Dow to Gold ratio fell to below 10. For those of you who are relatively new readers of “Portfolio Watch”, the Dow to Gold ratio is constructed by taking the value of the Dow Jones Industrial Average priced in US Dollars and dividing by the price of gold per ounce in US Dollars.

While the forecast level of one will require more big gains in gold, large declines in stocks, or some of each to reach, I stand by my forecast.

Keep in mind, markets rarely move in straight lines, but over the longer term, this will likely be bullish for gold and bearish for stocks.

What’s with This Crazy Silver Market?

While I discussed this recently, the continued, dramatic rise in silver prices does raise some questions.

Will the rally continue? If yes, how much longer?

Should I be taking profits now? Or should I be patient?

I’ll attempt to shed some light on this topic in this week’s “Portfolio Watch” since I’ve had many clients asking me these questions of late.

There are two ways to analyze any market: technically or fundamentally. Technical analysis looks at price and volume movements of a market and may incorporate other indicators. Fundamental analysis of a market considers conditions that may influence future prices.

Let’s begin by looking at a price chart of an exchange-traded fund that tracks the price of silver. For perspective, I’m sharing a weekly price chart; each bar on the chart represents one week of price action.

The price action on the chart is illustrated by the green and red bars. The green bars represent weeks in which the price of silver rose, and the red bars represent weeks in which the price of silver fell. The blue line on the chart is the 20-week moving average of price. Notice that over time, it’s highly unusual for prices to stray a long way from the moving average as they have now. This would suggest a pullback would not be surprising.

The red, vertical bars at the bottom of the chart illustrate trading volume. The higher the trading volume as prices rise, the more likely that the trend continues. In this case, with the exception of last week, trading volume supports higher prices.

Technically speaking, it seems that the long-term trend for silver prices may be higher, but a pullback COULD occur in the short-term.

Fundamentally, the demand for silver seems very strong.

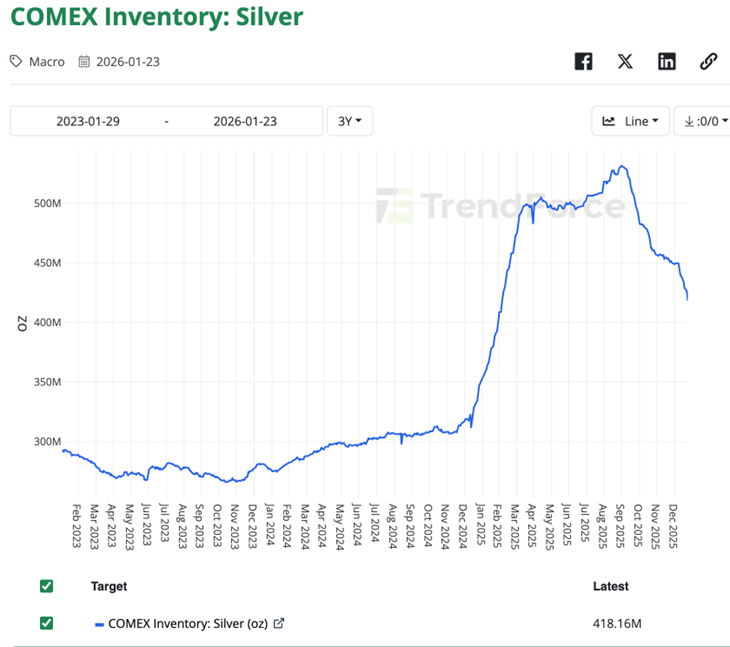

This chart, from COMEX, shows the silver inventory total on the COMEX.

Notice that since the silver inventory peak in October, inventories are down more than 20% as prices have risen.

Notice that since the silver inventory peak in October, inventories are down more than 20% as prices have risen.

That may suggest that there is more upside in silver in the future.

Then there’s the China factor when it comes to silver.

China has now classified silver as a ‘strategic material’ rather than an ordinary commodity. The change happened on the first of January 2026. (Source: https://www.cnbc.com/2025/12/31/china-silver-export-controls-2026-us-economy-prices-rare-earths-critical-minerals-xag-metals.html)

That classification change now treats silver just like rare earth minerals as far as export controls are concerned. Bottom line: China will be exporting less silver.

Elon Musk reacted by saying, “This is not good. Silver is needed in many industrial processes.”

These two fundamentals may mean more upside for silver in the future.

Note: this commentary is presented for entertainment and information purposes only. Seek professional advice before making any investment.

RLA Radio

The RLA radio program this week features my commentary and an interview that I did with Mr. Jeffrey Tucker, founder of the Brownstone Institute. The program is available by clicking the "Podcast" tab at the top of this page or on your favorite podcast channel.

Quote of the Week

“The only time people dislike gossip is when you gossip about them.”

-Will Rogers

Comments