Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

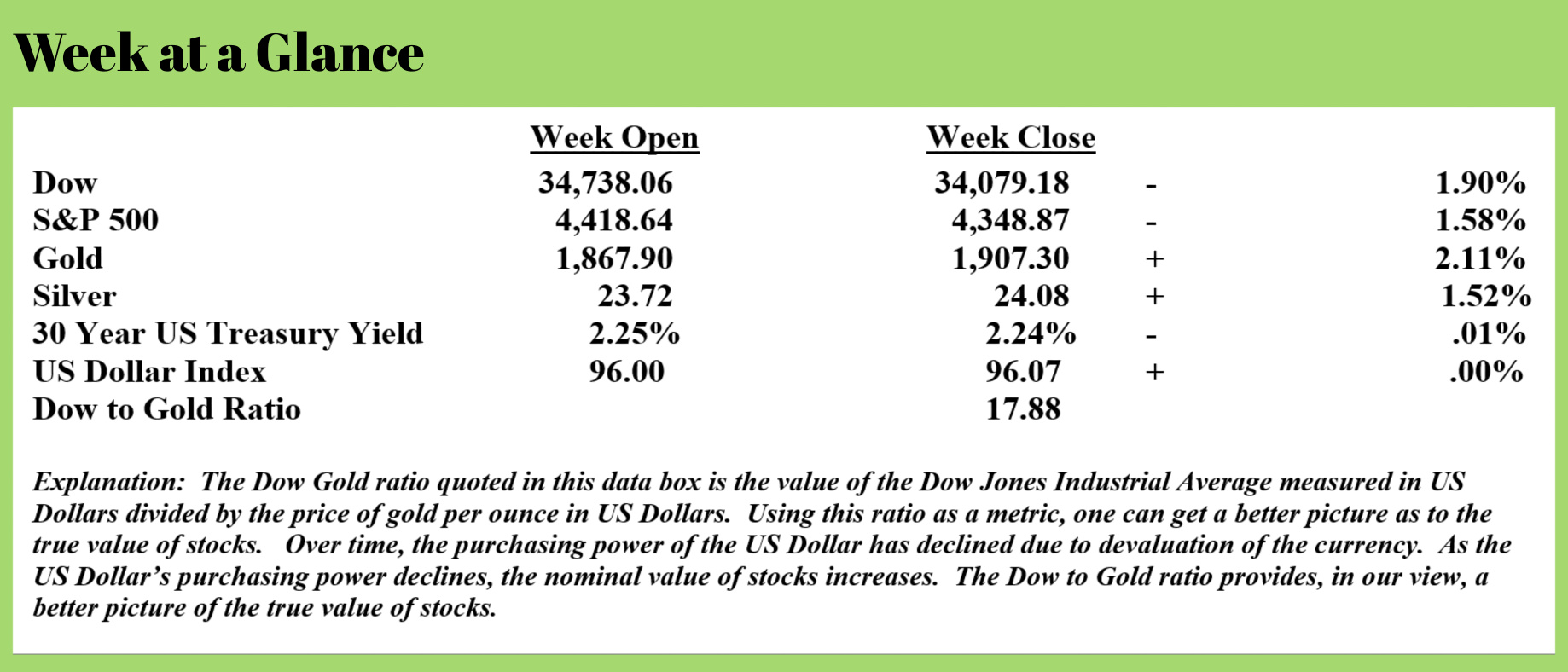

Stocks had another down week while gold and silver continued to rise. As noted last week, all major US stock indices are now trading below their 200-day moving averages, a technically significant level.

As a reminder, there is just one week remaining to request the February Special Report titled, “Stock Update: Is the Crash Upon Us?”. Visit www.RequestYourReport.com to request the report for yourself or someone else.

Inflation remains the dominant news story. The Federal Reserve called an emergency meeting last Monday that resulted in no action being taken regarding interest rates, a bit of a surprise to many analysts.

With inflation raging at levels not seen in 40 years, the Fed’s inaction is curious.

From my perspective, as I outline in the March “You May Not Know Report” real interest rates will need to be positive to make an impact on inflation. Here is a bit from the March report:

As an aside, but for an important point of clarification, the Fed does not buy US Government debt directly. The big banks buy the US Government debt and then the Fed buys the debt from the big banks using newly created currency.

I talk to many clients and radio show listeners who ask how much the Fed needs to raise interest rates to get inflation under control. While there is not a universally accepted answer to that question, the answer that is often given is that real interest rates need to be positive.

Here’s an example to make the point. Presently, the official inflation rate is 7.84%, which is the non-seasonally adjusted rate as of January. The yield on the 10-year US Treasury as this piece is being written is 2.035%. This means that an investor in a 10-Year US Treasury note experiences a real interest rate that is almost 6% negative!

When calculating the real inflation rate using the inflation calculation formula used in the late 1970’s and early 1980’s, rather than using the heavily manipulated Consumer Price Index, one concludes that the real inflation rate is about 16%.

In the early 1980’s when inflation was at this level, interest rates had to be increased to 20% to get inflation under control. With interest rates at 20%, real interest rates were positive, and inflation was eventually brought under control.

In my view, that is where we now find ourselves. With the real inflation rate at 16%, raising interest rates to 1% or 2% doesn’t make much of an impact on inflation. However, it will probably make a huge impact on financial markets. In calendar year 2018, when the Fed increased interest rates to a little over 2%, financial markets reacted very negatively. It’s my view they will react similarly again.

It’s my view that we are headed for higher consumer prices and a stagnating economy and distress in the financial markets. While the Fed is feeling political pressure to do something about inflation, the math dictates that the central bank won’t be able to raise rates enough to get inflation under control unless the federal government’s budget is balanced or gets a lot closer to balanced.

Since that is unlikely to happen anytime soon, the Fed’s actions with interest rates will be more form than substance. Inflation will probably continue and accelerate while financial markets react negatively to small increases in interest rates.

The reality is that there are many Americans feeling the pinch of rising inflation. Michael Snyder recently commented in an article he wrote stating that 70% of Americans are now living paycheck to paycheck. (Source: http://theeconomiccollapseblog.com/the-cost-of-living-in-the-united-states-is-rising-to-absolutely-absurd-levels/)

This paycheck-to-paycheck existence is directly attributed to inflation. Here is an excerpt from Mr. Snyder’s piece:

Over the past couple of years, the Federal Reserve has pumped trillions of fresh dollars into the financial system.

You just can’t “undo” that.

And our politicians in Washington have been on the biggest borrowing spree in all of human history. I think that many of them truly believed that there would never be any serious consequences, but as Forbes has aptly noted, we “are now paying a heavy price for this magical thinking”…

Unfortunately, Americans are now paying a heavy price for this magical thinking. Inflation—spurred at least in part by record government spending and inaction on other issues—is running at its highest rate since 1982. The prices for meat and eggs are up 12.2% since last year. Furniture and bedding is up 17% and used cars and trucks are up 40.5%.

Meanwhile, the Treasury Department recently reported America’s total national debt is now over $30 trillion—the highest ever. To put this in context: If you stacked $30 trillion of $100 bills you could almost reach the weather satellites orbiting the earth at over 20,000 miles above us.

Today, we have absolutely gigantic mountains of money chasing a smaller pool of goods and services because of the pandemic.

As a result, the cost of living has been soaring into the stratosphere.

For example, one new study found that 82.2 percent of new-vehicle buyers actually paid above sticker price during the month of January…

A study from the online marketplace found that 82.2% of new car buyers paid over the manufacturer’s suggested retail price (MSRP) in January, up from .3% in January 2020, before the coronavirus pandemic started affecting the industry

The average price paid above sticker was $728, while savvy shoppers were getting a discount of $2,648 just two years ago. Cadillac’s customers led the way by paying a $4,048 premium, followed by Land Rover’s ($2,565) and Kia‘s ($2,289).

In my entire lifetime, I have never seen anything like this.

Years ago, I remember spending hours hammering a salesman until I was totally satisfied that the dealership would not knock off a single penny more from the price of a used vehicle that I wanted.

But now things have completely changed.

Today, just about everyone is paying above MSRP.

Of course, it is becoming more expensive to fuel our vehicles as well. On Wednesday, the average price of a gallon of gasoline in California hit a brand new record high…

Gas in California hit a record high of $4.72 a gallon on average on Wednesday — and experts say a whopping $5 a gallon will likely be the norm there in a matter of months, if not sooner.

Sadly, five-dollar gas is only just the beginning.

In fact, one expert that was interviewed by Yahoo Finance has actually raised the specter of seven dollar gas…

Drivers best start bracing for another surge in gas prices amid the conflict between Russia and Ukraine and years of under-investment by the oil industry, warns one veteran energy strategist.

“My guess is that you are going to see $5 a gallon at any triple-digit [oil prices] … as soon as you get to $100. And you might get to $6.50 or $7. Forget about $150 a gallon, I don’t know where we will be by then,” Energy Word founder Dan Dicker said on Yahoo Finance Live.

Can you imagine paying seven dollars for a gallon of gasoline?

That definitely seems crazy to me. But soon it will happen.

Housing prices continue to surge as well. In fact, we are being told that a recent spike in lumber prices has increased the average price of a new home by nearly $19,000…

“If people aren’t listening now, the dire predictions that we’ve been making appear to be coming true,” National Association of Home Builders CEO Jerry Howard said on “Varney & Co.” Wednesday.

Volatile lumber prices have caused the average price of a new single-family home to increase by $18,600, according to a new statistic from the NAHB.

Heating our homes is becoming a lot more painful too. According to the Heartland Institute, the average American family saw their heating and cooling costs jump “by as much as $1,000” last year…

A new analysis by the Heartland Institute reports the typical American family’s home heating and cooling costs increased by as much as $1,000 in 2021 as a result of President Joe Biden’s energy and environmental policies.

Needless to say, most Americans were not prepared for a dramatic shift in the cost of living such as this. At this point, 70 percent of Americans are living paycheck to paycheck.

So how are people making ends meet? Well, we just found out that credit card debt rose at the fastest pace ever seen during the fourth quarter of 2021…

As I have been suggesting, the best course of action is to hedge for both inflation and deflation using the Revenue Sourcing™ planning strategy.

This week’s radio program and podcast features an interview with Karl Denninger who offers some interesting perspectives on currency creation and balancing the federal budget.

It’s a thought-provoking interview. You can listen now by clicking on the "Podcast" tab at the top of this page.

“A hero is no braver than an ordinary man, but he is braver 5 minutes longer.”

-Ralph Waldo Emerson