Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

Silver Corrects

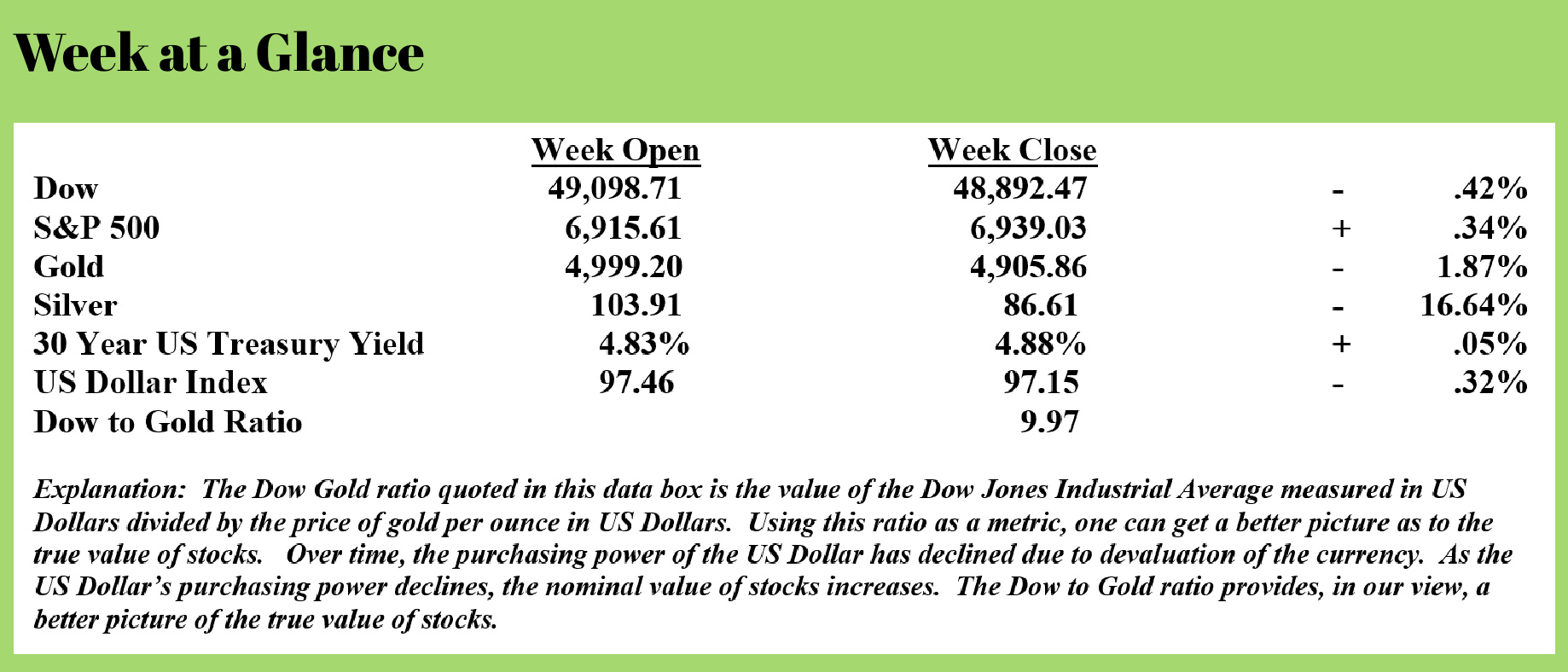

After I suggested last week that silver could be due for a correction, it happened.

Silver fell more than 16% for the week but remains up year-to-date by about 12%.

As noted last week, technically speaking, the silver market was very overbought – in other words, the rally got a bit ahead of itself. Silver’s pullback brings it back in line with the 50-day moving average, which means silver is still in an uptrend. This will be the case as long as silver prices remain above the 200-day moving average.

The chart below shows an exchange-traded fund that tracks the price of silver. On the chart, I’ve drawn a 50-day, 100-day, and 200-day moving average. Notice that the moving averages are aligned; the 50-day is above the 100-day, and the 100-day is above the 200-day.

This is still a healthy uptrend, technically speaking.

This is still a healthy uptrend, technically speaking.

I expect that the silver market could pull back a little more or at least consolidate for a period.

Long-term, though, the fundamentals favor higher silver prices in my view.

The Economy Really Is “K-Shaped”

As we’ve discussed in this weekly report previously, one of the effects of easy money policies over time is the widening of the wealth gap. Put another way, the rich get richer and the poor struggle more.

A recent US Bank report revealed that the wealth gap is widening even more (Source: https://www.cnbc.com/2026/01/30/wealth-inequality-k-shaped-economy-united-states-consumer-spending-trump.html).

The top 1% of Americans, as far as net worth is concerned, hit a record share of 32% in the third quarter of last year. That means the top 1%, the wealthiest Americans, control almost 1/3rd of the wealth in the country.

By comparison, the bottom 50% own about 2.5% of total wealth.

To be fair, a wealth gap has always existed. There have always been those who are more economically well-off and those who are not as affluent. The basic reason is that different people have different skill sets and different desires and goals.

However, there is no denying that in an environment of easy money policies that fuel both price inflation and asset inflation, those with assets tend to fare far better since assets tend to appreciate in an inflationary climate.

Just looking at the news, one can see additional evidence of this “K-Shaped” economy. Airlines are building out more luxury options for first-class travelers. Both Boeing and Airbus are reporting delayed aircraft deliveries due to the addition of more luxurious seating and options in the first-class section of new airliners. (Source: https://www.cnbc.com/2025/03/02/first-class-seats-holding-up-new-airplanes.html). These options include private doors, heated and cooled seats, and HD televisions.

At the same time, quick-serve restaurants are building out their ‘value menus’ to offer price-conscious consumers more menu choices that are budget-oriented. (Source: https://www.cnbc.com/2025/12/28/value-meals-restaurants-mcdonalds-chilis-taco-bell.html). Traffic at restaurants is down year-over-year.

One restaurant chain, McDonald's, has introduced a $5 value meal to win back price-conscious diners. Many other chain restaurants are charting a similar course to win back customers.

Are Robots and AI Taking Over?

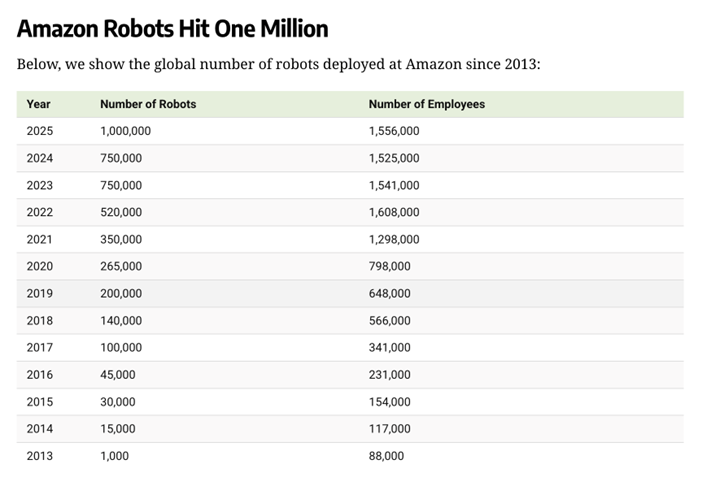

Amazon recently announced additional layoffs of more than 16,000 employees. (Source: https://www.visualcapitalist.com/rise-of-amazons-robot-workforce-vs-employees/)

The recent16,000 layoffs followed 14,000 layoffs from Amazon in October 2025.

While there is no statement to confirm this from Amazon, one has to wonder if these layoffs, or at least many of these layoffs, can be attributed to the increased utilization of robots by Amazon in the company’s warehouse operations.

Amazon’s employee count peaked in 2022 at more than 1.6 million. Not surprisingly, the number of robots in use at Amazon reached its highest level last year, as noted by this chart. (Source: https://www.visualcapitalist.com/rise-of-amazons-robot-workforce-vs-employees/)

Amazon’s employee count peaked in 2022 at more than 1.6 million. Not surprisingly, the number of robots in use at Amazon reached its highest level last year, as noted by this chart. (Source: https://www.visualcapitalist.com/rise-of-amazons-robot-workforce-vs-employees/)

The CEO of Amazon, Andy Jassy, has been very open about the fact that the company will require fewer employees as they move toward more automation via robots, as well as the use of artificial intelligence.

The move toward more automation does open more high-paying jobs managing robots and AI technologies.

RLA Radio

The RLA radio program this week features a ‘best of’ program with my commentary and an interview that I did with Mr. Jeffrey Tucker, founder of the Brownstone Institute. Listen now by clicking on the "Podcast" tab at the top of this page.

Quote of the Week

“What luck for rulers that men do not think.”

-Adolf Hitler

Comments