Weekly Market Update by Retirement Lifestyle Advocates

Last week in the markets was

in a word – DREADFUL.

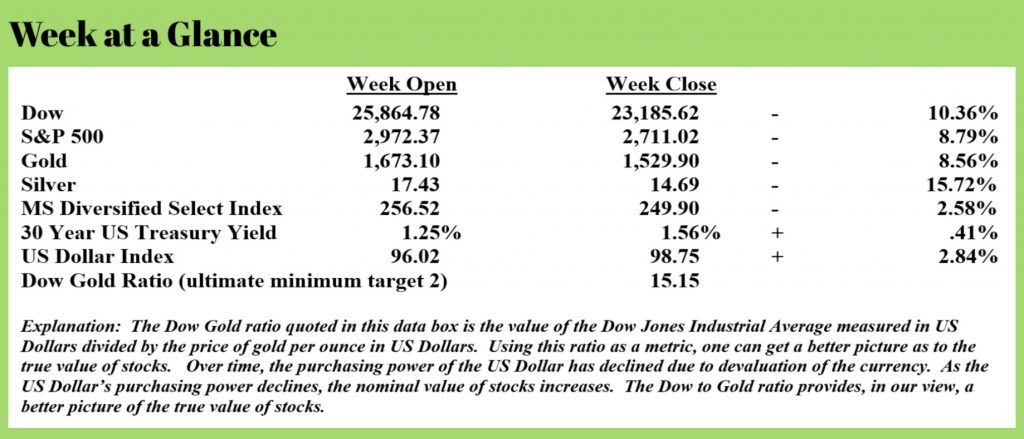

Stocks fell with the Dow

Jones Industrial Average declining more than 10% and the broader S&P 500

Index declining nearly 9%. Precious

metals shared in the tough week that stocks endured with gold falling about

8.5% and silver plummeting nearly 16%.

US Treasuries fell as well

with yields on the 30-Year bond rebounding to about 1.5% after (remarkably)

falling below 1% on March 9. Financial

markets are in turmoil.

If you’ve been a long-time reader of “Portfolio Watch”, you know that we have been forecasting a major stock decline. Obviously, predicting what the catalyst for such a decline might be is impossible, but stock valuations have been there for all to see.

Stocks, even at these levels

remain overvalued in our view. Market

volatility remains extremely high. From

our experience, volatility of this magnitude signals more rough days lie ahead

for stocks. Incredibly, he volatility

that existed in the market last week has not been seen in nearly 90 years. This from “Bloomberg” (Source:

https://www.bloombergquint.com/markets/the-s-p-500-had-its-choppiest-week-since-hoover-was-president) (emphasis added):

Price

swings in the U.S. equity market this week were more extreme than they’ve

been since Herbert Hoover was president. The S&P 500 Index moved at

least 4% in each of the five days, falling three times and rising twice. The

last such stretch of moves of that magnitude occurred in 1929.

Investors were whipsawed this week

amid growing angst over the coronavirus and an oil price war that sent crude

prices plunging. The benchmark index jumped 9.3% on Friday after President

Donald Trump declared a national emergency to help combat the virus. That

followed a 9.5% drop the previous day, when his travel ban and tepid fiscal

measures disappointed traders. The last time a 9% rout gave was in 1931 at the height of the Great Depression.

So, if you’re

invested in stocks, what should you do?

Our advice hasn’t changed. Use

the two-bucket approach for managing your nest egg. One bucket of assets contains investments

that are insulated from market fluctuations.

It’s this bucket from which you’ll pull needed income. The second bucket contains assets that you

may not need for income. Some of these

assets can be in stocks or stock derivatives but we’d suggest strong hedging in

this environment of extreme volatility.

While markets

typically don’t go straight up or straight down, it would not be surprising to

see more ultimate downside for stocks.

We have long predicted a Dow to Gold ratio of two and we are of the

belief that recent price action in stocks is the first step toward that

ultimate scenario.

Also, as we’ve

been suggesting would be the case the Fed responded by cutting interest rates

by a half percentage point a little more than a week ago and then printing

money last week. We forecast a rate cut

to zero within the next week or two and then more money printing; a.k.a.

quantitative easing.

As we have

been discussing periodically in this weekly update, the Federal Reserve has

been supporting, a.k.a. propping up the repo market since September. For new readers to “Portfolio Watch”, the

repo market is the overnight lending market between banks. At an ever-increasing rate since September,

the Fed has been printing money and acting as a lender of last resort to some banks. As we reported at the time, this was a red

flag and likely a harbinger of trouble to come.

Seems that

trouble has now arrived in earnest.

While the coronavirus is taking all the blame just like the terrorist

attacks of 2001 took the blame for the tech stock bubble imploding, market

crashes don’t occur unless conditions are ripe for a correction. This correction has been catalyzed by the

coronavirus but, as we have been commenting, stock valuations have been

stretched to levels that were even greater than prior to the great crash that

occurred in 1929.

Back to the

Federal Reserve action of last week.

On Thursday at

1:12 PM, “The Street” reported that the New York Fed would inject $500 billion

into the Treasury market. This from the

report (Source: https://www.thestreet.com/video/stocks-federal-reserve-injection)

All

three major U.S. stocks indexes were down more than 8% at one point on

Thursday, before the New York Fed announced it will inject $500 billion of cash

into the treasury market, buying securities across the duration scale to keep

interest rates low and banks flush with cash.

Then,

a piece released about an hour later by “Business Insider” reported that the

Fed would be injecting $1.5 trillion into the markets. This from the article (Source: https://markets.businessinsider.com/news/stocks/fed-repo-trillions-added-to-fight-coronavirus-economic-risk-recession-2020-3-1028991278)

The

Federal Reserve Bank of New York will start adding fresh capital to money

markets on Thursday to pad against coronavirus risks and ease stresses on the

Treasury-bill market.

The extraordinary funding measure first involves a $500 billion

injection at 1:30 p.m. ET on Thursday, the bank said.

The cash will be added to money markets through a three-month market

repurchase agreement, or repo operation.

One-month and three-month repos for $500 billion each will be

conducted on Friday and continue to be offered weekly through the calendar

month, the bank added.

The massive stimulus measure was

made in accordance with the Federal Open Market Committee and in response to unprecedented liquidity issues in the Treasury-bond market, the New York Fed

said.

This from “Forbes” (Source: https://www.forbes.com/sites/sarahhansen/2020/03/12/fed-injects-15-trillion-to-prop-up-crashing-markets/#6c71536b6adb):

As

stocks headed for their worst day since 1987’s

Black Monday Crash, the Federal Reserve announced

further measures to prop up liquidity including a potential injection of more

than $1.5 trillion into the market; stocks responded immediately, cutting

losses in half on the announcement, before dropping back down 8%.

- The Fed said it will

ramp up its overnight funding operations—buying “repos,” or repurchase

agreements—by $1.5 trillion over the next two days. - “These changes are

being made to address highly unusual disruptions in Treasury financing markets associated with the

coronavirus outbreak,” the New York Fed said in a statement on Thursday afternoon.

Note that in the “Forbes” piece and the

“Business Insider” piece that the phrases “highly unusual disruptions” and

“unprecedented liquidity issues” are used to describe the US Treasury market.

What does this mean?

When stocks are declining hard, one would

expect to see investors who are concerned about preserving assets flock from

stocks to bonds. That demand for bonds

would have bond prices rise and yields decline.

That’s what happened through the 9th when the yield on the

30-Year US Treasury fell to under 1%.

Then, within a few days the Fed had to inject

$1.5 trillion into the repo market where a lot of bond buying and selling takes

place. What happened?

Perhaps no buyers.

This from Bank of America strategist, Mark Cabana as reported by Reuters

(Source: https://www.reuters.com/article/usa-bonds-bankofamerica/u-s-fed-treasury-may-need-to-buy-treasuries-to-stop-broad-sell-off-bofa-idUSL1N2B50UN)

“In a risk-off environment it would

be expected to see (Treasury) yields decline; yields appear to have been

overwhelmed by liquidity concerns yesterday.”

The

Federal Reserve induced stock market bubble is now unraveling. The $1.5 trillion injection into the bond

market likely ensures a similar outcome for bonds.

Protect

yourself. Diversify and own some

tangible assets.

That is one of

the core characteristics of using the two bucket approach to managing

assets. The two-bucket approach has an

investor diversifying out of the traditional one-bucket stock and bond

approach.

As history

teaches us, eventually such an approach will fail when central banks begin the

practice of money creation. We are now

on a very slippery slope and past the point of no return when it comes to money

creation.

After the financial crisis, the Fed engaged in quantitative easing to the tune of $85 billion per month, or about $1 trillion per year. Last week, in one day, QE totaled $1.5 trillion. If you’ve been procrastinating or waiting for the market to recover before you look into the two-bucket approach, we are of the strong conviction that the time to act is now.

This week’s Retirement Lifestyle Advocates Radio Program is now

posted at www.RetirementLifestyleAdvocates.com. This week host, Dennis

Tubbergen interviews a very bright economist, Mr. Allasdair Macleod. They talk almost exclusively about this

topic. Don’t miss this interview.

If you are not yet a client of Retirement Lifestyle Advocates and

would like to learn more about using the two-bucket approach to manage your

assets, you may call the office and request a free meeting to discuss (be

patient, we are busy) at 1-866-921-3613.

“Life isn’t about waiting for the storm to pass. It’s about learning to dance in the rain.”

-Vivian Greene